Republicans have set their sights on making the Tax Cuts and Jobs Act permanent. They just need to figure out a way to bypass the Senate rules that prevent reconciliation bills from impacting the deficit beyond its budget window.

Before even having a tax bill to debate, Republicans are teeing up a fight over the Byrd Rule — which dictates how reconciliation bills can impact the budget.

Extending the TCJA is estimated to result in a $4.5 trillion loss in revenue over the next 10 years. Making the tax cuts permanent would clearly run afoul of the rules. That’s not the only math problem Republicans are facing; House lawmakers are meeting this week to discuss how to make the numbers add up between the existing tax cuts, and Trump’s new proposals — like no tax on tips.

But if Senate Republicans can find a way to have the extension evaluated on a current policy baseline instead of a current law baseline, the on-paper revenue loss becomes $0, and a permanent extension is suddenly within the confines of the Byrd Rule.

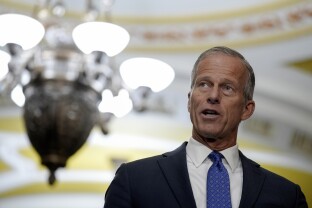

Senate Majority Leader John Thune told Politico that while he’s working with the parliamentarian, he believes the baseline decision to be up to the budget chair. Sen. Lindsey Graham, who chairs the budget committee, told NOTUS it was “probably” up to the Senate Parliamentarian.

“I think we’re in really good shape. They’ve used this concept before, the Democrats have. So I’d be astonished that we can’t do it,” he said.

Sen. Elizabeth Warren, ranking member on the Senate Finance Committee, laughed at the idea.

“There is no precedent — this is not what the rules of Congress require,” she told NOTUS. “They are desperate to deliver tax giveaways for billionaires, and they’re willing to lie to the American people and claim it costs nothing, because they think they will escape the political costs of that decision. They’re wrong.”

Warren was recently joined by Sen. Peter Welch and three other Democratic senators on a letter requesting information on scoring methods from the Joint Committee on Taxation.

“It’s a game to try to pretend a bill that’ll add $5 trillion dollars to the deficit won’t add $5 trillion dollars to the deficit,” Welch told NOTUS. “The real meaning here is ‘What’s the impact on the deficit?’and you can’t change that by using the term policy.”

In a response to Senate lawmakers on Friday, the JCT confirmed that a “present law baseline” has been the default scoring method since the 1970s, though they have on numerous occasions provided estimates to lawmakers of the fiscal impact of legislation when evaluated on a current policy baseline.

What’s more certain is Republicans’ appetite to pursue the permanent tax cuts.

“The most important thing we can do to ensure the economy keeps growing, wages keep growing, ensure that America remains globally competitive is to make the Trump tax cuts from 2017 permanent,” Sen. Steve Daines said. “Remove the uncertainty Washington, D.C., presents to businesses and the American people. Take that off the table. Our passion for spending reductions must be equal to our passion for keeping tax rates low.”

Even Sen. Rand Paul, one of the Senate’s notorious fiscal hawks, told NOTUS he’s fine with using the current policy baseline.

“I think keeping a tax cut is not something that should be considered to be loss of revenue,” Paul told NOTUS. “We’ve had the tax cuts for seven years, I’m for keeping them, and if that means calling it policy versus law, I’m OK with it.”

Senate Finance Committee Chair Mike Crapo has been a leading proponent in Congress for using the current policy baseline. Ranking member Sen. Ron Wyden told NOTUS that he has been spending a lot of time in the parliamentarian’s office.

“ There’s lots of tricks and ways in which you can try,” Wyden said when asked if Republicans could choose the baseline without the parliamentarian. “The Senate parliamentarian is very professional. And I’ll leave it at that.”

That said, a number of deficit-conscious Republican members, like Rep. Dave Schweikert, have expressed qualms.

Circumventing the Senate Parliamentarian’s rulings is massively controversial and would be equivalent to nuking the filibuster by Thune’s own assessment. The Senate has yet to draft a budget resolution for its version of the tax bill and is currently in the process of considering changes to the budget resolution that passed the House — that bill uses a current law baseline and is not otherwise set up for a permanent extension of the Trump tax cuts.

Adam Michel, director of tax policy studies at the Cato Institute, emphasized that there is another way for Republicans to make the tax cuts permanent without changing the baseline: offsetting the cost of a full extension within the House’s budget framework.

“The only requirement is you can’t increase deficits outside the window, which just means you need spending offsets and or tax offsets outside the window. And there are trillions of dollars of spending cuts that Republicans have supported in the past and just as many dollars worth of tax expenditure reforms that Republicans have voted for in the past,” Michel said, pointing to policies like the Inflation Reduction Act tax credits and the State and Local Tax deduction for corporations.

House Republicans are currently on the hunt for $2 trillion in spending cuts to offset the $4.5 trillion dollars in revenue loss associated with a 10-year extension. This is already proving difficult for Republicans who, in making cuts to pay for the tax cuts, would almost certainly have to stymie the flow of federal dollars to their home states for social programs. To fully offset the cost of a permanent extension, they’d have to find even more in cuts.

“The sort of narrative that’s being pushed that the only way to make tax cuts permanent is under a current policy baseline, is really just saying that Republicans don’t want to do the hard work of actual tax reform and actual spending reform,” Michel said. “I don’t think that’s something that we should let them get away with.”

—

Violet Jira is a NOTUS reporter and an Allbritton Journalism Institute fellow.

Sign in

Log into your free account with your email. Don’t have one?

Check your email for a one-time code.

We sent a 4-digit code to . Enter the pin to confirm your account.

New code will be available in 1:00

Let’s try this again.

We encountered an error with the passcode sent to . Please reenter your email.